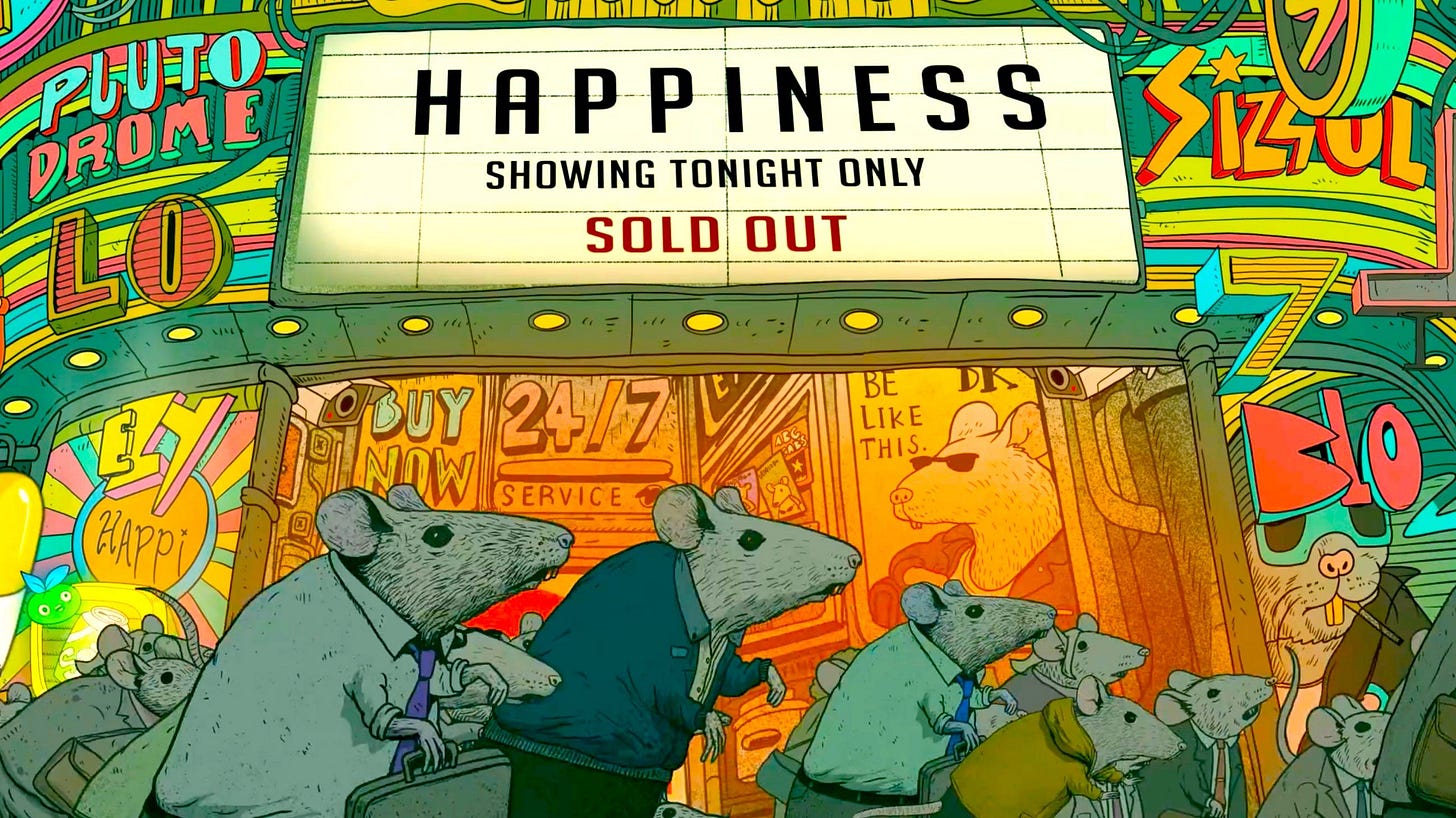

Prioritizing profitability gets you out of the rat race

Not profitable = always looking for investors, kowtowing to them, etc.

I was looking at this Linkedin post from this guy I’ve known for a number of years…. and he was attending some type of investment conference presenting his startup.

He seems to do a lot of these from the Linkedin posts I see.

It’s like he’s always trying to attract investor attention. Even though I don’t think his company is that big.

And I just don’t get it.

Why waste all of this effort trying to raise money all of the time. It must be exhausting.

And I bet it distracts him from running his actual business.

I, for example, do not go to any of these investor conferences. And I never pitch my startup at any of these events.

Why? Because it is much better and easier in my view to adopt a model and way of working that enables you to be profitable early on and continuously.

The investor trap

Lots of young startups think… “ok I need to raise money.”

And so they focus a lot on this early on thinking it is like the Holy Grail.

But not knowing that for many startups these investors end up being a living nightmare.

I had an old friend ping me the other day. He’d started his startup in about 2012 and is still running it today. They’ve grown a lot and he has a lot to be proud of.

But the first thing he says to me is something like… “Ken… I wanna sell and get out. My investors are a pain in the ass to manage and I’m just not enjoying it anymore.”

Another old friend that runs a pretty big VC-backed ecom biz visited Bangkok the other week and I asked him about a person I advised him not to hire. His answer was like “I didn’t want to, but I had to hire her. My board wanted her.”

I plan to avoid this investor trap

When I think of these instances I am like… “What a rat race that is. I hire and fire whoever the fuck i want. Whenever the fuck i want. And I plan to always keep it that way.”

How?

Because i don’t plan to give investors any meaningful control in my company. At least not till i’ve checked out.

Does that mean i will not accept any investor checks?

Also no.

We have let in some angel investors and will add a few more. But we do so with a fast growing business that is consistently profitable.

Which translates into leverage.

If Mr. Investor doesn’t want to invest without having some control… i give him the old “Sayonara!”

Because my company runs just fine without any of this investor money. And it’s a completely different game in my view.

I never have to go groveling to investors and I plan to never have to. Does that mean I might grow a bit slower?

Yes perhaps.

But I’m willing to make that tradeoff.

Prioritizing profit

I cannot emphasize this to other entrepreneurs enough. Think about models and operating processes that enable you to be profitable early on.

Your life will be a thousand times easier.

And for me it is often even more the processes you choose to use rather than the model. Many models can be profitable early on if you are smart about it.

For example I use freelancers and pay them for what they do. Everything is a clickup task and they assign hours to it.

I honestly don’t know why more startup founders are not doing this. Or if they don’t know how to do it, they should be pounding down my door to figure out how.

Because it is so critical to running lean operations.

Profitability = Don’t hire employees

I pay people for what they do when I have priority work for them to do. And I pay them nothing when I do not.

Contrast this to many startup founders who go out and hire some employees and then pay them a full-time salary. The amount of time they will spend on truly high priority work is perhaps 25-40%.

How do I know? Am I pulling this number out of my ass?

No. Because that is about how much time my fractional lieutenants in Reviv spend each week on the business.

And I love feeling absolutely no need to try to keep them busy the rest of the time.

If I decide I wanna stop growing my business aggressively and instead just reap profits I can flip that button in a few hours. And just cut what the team does by about 80% so that we’re only sustaining the critical processes.

No layoffs. No corporate emails explaining myself.

And i guarantee I will remain friends with everyone and can bring them back on later if we want.

Closing thoughts

Your traditional startup that raises venture funding is almost constantly in a rat race.

Their valuation is based on their growth.

If they don’t grow their valuation drops. And if that happens the terms of the VC term sheets they signed usually ends up screwing them.

So there is no choice but to grow. And there is no such thing as just putting your foot on the break and milking profits for awhile.

As a result even after years of beating the odds and creating a sustainable business… they still often hate their lives like my friend.

Because they’re kowtowing to investors who often have conflicting interests.

Far far better in my view to be the entrepreneur who runs a profitable business and does what he wants.

I mean.. isn’t that the main reason we started a business in the first place?